T18 Group1

Contents

Internet Banking

History Of Internet Banking

Internet banking was developed in the late 1980s however, it first become popular in the early 1990s. Internet Banking has shown a trend of gaining in popularity, with customers shifting their practices from visiting their bank’s branches to simply accessing their account information with a click of a mouse from the comfort of their own homes. This trend is supported in the US with Americans increasing their Internet banking usage from 14 million users to 53 million users during the years 2001 to 2004. Internet Banking has proved to be yet another web-based phenomenon that features convenience as one of its greatest assets. Customers no longer have to organize their schedules to meet their bank’s hours, but instead can fulfill their banking needs according to their most suitable times. Internet banking technology has evolved drastically in comparison to its first existence. Early Internet banking websites contained simple layouts with a sign in and bank balance information. Today however, Internet Banking provides much more access by allowing customers to arrange for loans, set up debits, pay bills online, balance cheque books, and even trade stocks and bonds. However, like every other piece of technology available, Internet Banking does not come without its flaws. These flaws include; system crashes, fraudulent activities, identify theft and security breeches. Some customers claim that these potential risks associated with Internet Banking outweigh the benefits, while others argue that these risks can be avoided with safe online banking practices. The further segment discusses advantages, disadvantages, attacks, security practices used by companies as well as improvement in Internet Banking technology,

Advantages of Internet Banking

There are many Advantages associated with online banking, these include:

- CONVENIENCE: Time is the most important aspect for many business professionals, and busy parents. With Internet banking readily available online virtually 24-hours a day, 7 days a week, individuals can bank anytime suitable to their personal schedules. No longer do individuals have to fuss with getting to the bank on-time or before it closes, they can simply access their account information from the comfort of their own homes.

- INSIGHT: With Internet banking one can easily see which Bank is the best for their own personal uses. For example an individual can easily compare two banks by examining their offered interest rates, contrasting the different saving options that each banks provides, and comparing which bank offers lower service fee charges. This can be done easily from a third view perspective from online as opposed to simply believing all the offers mentioned by associates who work for the bank.

- SPEED: Internet banking usually meets or even exceeds ATM processing times for different types of transactions.

- EFFICIENCY: As opposed to having hundreds of employees to tailor to customer demands at the bank, Internet Banking provides cost-reductions for companies by allowing them to provide the same services without hiring as many employees.

Disadvantages to Internet Banking

- SECURITY ISSUES: This is the most prevalent issue with online banking, as personal information can be stolen or bank account information can be used for fraudulent purposes. Many of these issues arise because the individual using the services provided does not have proper Internet security, is using websites that are fraudulent, or the website itself is experiencing security breeches. Other security issues include potential risks of virtual attacks, unauthorized access and identity theft.

- DIFFICULTY: It may be difficult for individuals inexperienced with new emerging technology to use the online website provided by their bank. For example an individual might have problems with navigation on the website. With the impersonal aspect of the web it can be hard or time-consuming for them to get the help necessary in order to address their issues.

- START-UP: Not every aspect of Internet Banking is truly online. For example to set-up an online account, customers must visit their bank and sign forums relating to their online banking use. This may be time-consuming.

Quick Tips for Effective Internet Banking

- Although online banking is available 24/7, transactions may still be made in accordance to business hours/days. Therefore it is still important for customers to use internet banking while being mindful of generally accepted business days in order to make sure that their transactions are received on desired dates.

- Periodically change the password on your account. This will ensure that unauthorized access is much more difficult to attain on your account. Also if a security breech does occur, a password change may ensure that the breech does not occur again.

- Never give out personal information, unless if you are sure that the website you are using is an authorized one that is known to be secure.

- Routinely check your computer for any viruses or spy ware that might have impacted your computer.

- Always ensure to have anti virus protection on your computer especially if all your personal information is also located online.

- Make sure to see that the online banking website has high end encryption which makes information scrambled, thus creating it to be harder for hackers to reach. A site’s encryption information is usually located at the bottom right of websites, showing that encryption is in place.

Internet Banking Security

Internet banking security provides users with fast and effective ways to safely complete everyday banking transactions online.

Online Banking Security Comparisons

RBC

https://www.rbcroyalbank.com/onlinebanking/bankingusertips/security/index.html

The Royal Bank of Canada provides its users with a number of methods and securities to protect their customers when internet banking. These include RBC online banking security guarantees that reimburses their users 100% if an unauthorized transaction is completed. RBC recommends that users learn about internet security to enable safe computer practicing. Some of the safety features that RBC provides are:

- Sign-in protection- providing a personal verification question upon sign-in.

- Activation code- provides immediate but limited access to internet banking.

- Personal Verification Questions- providing 3 personal verification questions.

- Use of Cookies- provide secure navigation through web site and ensure security.

- Encryption- Cookies are always encrypted so that the information inside the cookie file can only be decoded and read by RBC.

- E-mail and Security- General Email is not secure so the bank provides a secure mail feature.

The bank also provides important security notices. These notify users of:

- Fraud Advisories- These include fraudulent emails, chat room frauds, as well as pop up advertising.

- Security Advisory- This includes ways to help protect your computer.

CIBC

http://www.cibc.com/ca/legal/online-banking-security.html

The Canadian Imperial Bank of Commerce also provides its customers with an online banking guarantee that refunds 100% of any unauthorized transactions. Some of the ways that CIBC protects their clients is through:

- Browser security- web browsers are checked to ensure it meets minimum requirement.

- Online Banking Security- through verification questions, the date and time of last sign on, web browser encryption, and session timeouts.

- Use of Cookies- provide secure navigation through web site and ensure security.

- Privacy Policy- protection of privacy agreement.

CIBC provides ways in which to protect yourself when internet banking, they provide information on what you can do, safe computing practices, and clearing your browsers cache. CIBC also outlines fraud practices for users to be aware of:

- Debit Card Skimming

- Cheque Fraud

- Identity Fraud

- E-mail and Text Messaging Fraud

- Credit Card Fraud

- Accounts Payable Fraud

- Moving Money for Strangers

- Internet Stock Fraud

- Spyware

BMO

https://www1.bmo.com/cgi-bin/netbnx/NBmain

The Bank of Montreal provides its users many of the same securtiy functions as the banks mentioned above. This includes an online banking guarantee, security notes, considerations for safe online banking, warnings for fraud software downloads, scam protection, and email encryption. Other Security measures include:

- Digital Certificates- isseued by trusted third partie companies to ensure the site is genuine and safe

- Firewalls- protect account information

Security

The three banks compared seem to have very similar security and protection options. The most commonly used protection was encryption. Encryption was used by many other banks that we came accross in our research and seems to be an effective way for a bank to ensure security. All banks advise user to be knowledgable of security options and ways to safely internet bank. With the combination of the banks security and user knowledge internet banking can be a safe an effective method of banking.

New Technologies

Mobile Banking

Other names include: M-Banking or SMS Banking. Mobile banking is a branch of online banking only you use your mobile phone. Can be used to perform balance checks, account transactions, payments etc. According to many studies the growth of mobile phones is growing and with the growth of mobile phones, mobile banking has become more popular. It is predicted that that mobile banking will only become more popular as well, especially in Asian or European countries where fixed-lined infrastructures are less stable. Smart phones have become the most popular way to approach mobile banking. In resent years many companies have invested billions of dollars towards online banking and mobile banking, making banking through these systems easier and more sophisticated.

Mobile Banking Services

Mobile Banking offers most basic services such as:

Account Information

- Mini-statements and checking of account history

- Alerts on account activity or passing of set thresholds

- Monitoring of term deposits

- Access to loan statements

- Access to card statements

- Mutual funds / equity statements

- Insurance policy management

- Pension plan management

- Status on cheque, stop payment on cheque

Payments, Deposits, Withdrawals, and Transfers

- Domestic and international fund transfers

- Micro-payment handling

- Mobile recharging

- Commercial payment processing

- Bill payment processing

- Peer to Peer payments

- Withdrawal at banking agent

- Deposit at banking agent

Mobile banking is important to bank clients that are located in remote locations or are in a remote area for a period of time. This new technology has made it possible for people to look after their banking issues in more situations in which we could never do in the past. These procedures are made possible by SMS (Short Message Service). A specific series of messages allow the client to verify if they sufficient funds and with a few other specific series of messages the client is able to perform many mobile banking services.

Challenges for Mobile Banking

Interoperability

From the lack of technology standards in mobile banking, mobile banking can lead to security issues. Some protocols being used are HTML, WAP, SOAP, XML. It is recommended that a vender can connect to multiple banks and or use a widely known protocol for data exchange. Another issue is the large variety of mobile phones, which makes it difficult for banks to offer a banking solution. Interoperability is mainly based on the banks to discover the most secure and easily accessible program of mobile banking.

Security

Security of financial transactions, being executed from some remote location and transmission of financial information over the air, are the most complicated challenges that need to be addressed jointly by mobile application developers, wireless network service providers and the banks' IT departments. Issues of mobile banking present some of the same problems of online banking and can be solved with the following:

- Physical part of the hand-held device. If the bank is offering smart-card based security, the physical security of the device is more important.

- Security of any thick-client application running on the device. In case the device is stolen, the hacker should require at least an ID/Password to access the application.

- Authentication of the device with service provider before initiating a transaction. This would ensure that unauthorized devices are not connected to perform financial transactions.

- User ID / Password authentication of bank’s customer.

- Encryption of the data being transmitted over the air.

- Encryption of the data that will be stored in device for later / off-line analysis by the customer.

Internet Banking Scams

Online banking is a very convenient way to go on with your money transactions; it is easy, fast and relatively safe. However if certain precautions are not taken it can be really dangerous and your money could very well end up being at stake. Since online banking was created it has been subject to different attacks by hackers and cyber-criminals, which are in the constant quest of emptying the bank accounts of their victims and there are different ways they use to do this.

Phishing

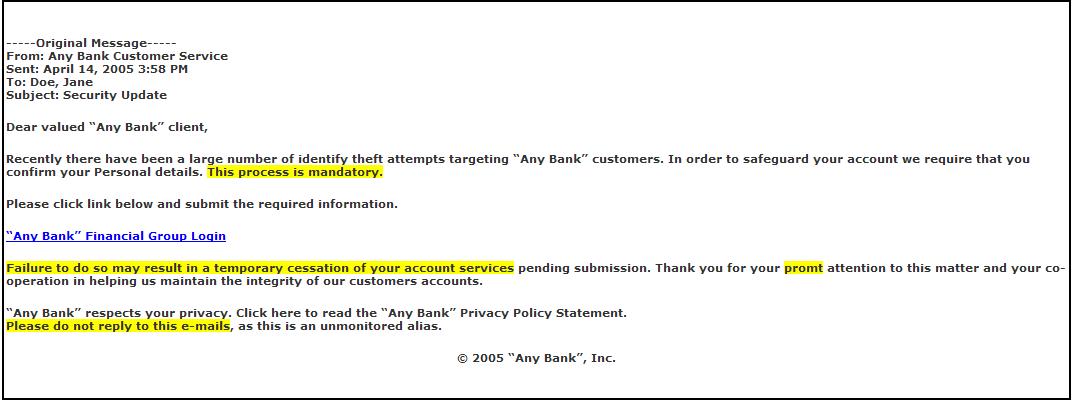

Phishing is the most common method by cyber-criminals. It consists on fraudulent e-mail messages and websites that resemble the one of a specific bank or credit card company. The criminals send these messages to thousands of people at once in a form of spam, although these e-mails might contain the official logo of the bank or organization they are run by criminals. This form of spamming is what gives the method the name because they are “phishing” for information.

On these e-mails the scammers will often ask to fill some forms to validate or update your personal information, such as a pin number, social insurance number or password; stating that if the user does not comply immediately the account will be frozen or even cancelled. Most of these emails will contain a link that will take the user to an also fraudulent website where they will have you fill out these forms. With this method the criminals basically trick the user to give them their personal information.

Vishing

Vishing stands for “voice phishing” and its basically a twist that has appeared recently on phishing emails. This threat involves an e-mail just like in phishing; however in it the visher will ask for the costumer to make a call to a local or toll free number where an automated attendant will ask to punch in your credit card number and password. This information is saved and later used for criminals to access the bank accounts.

Trojan Horses

Another approach to online banking fraud is the use of Trojan horses and key-loggers. These are programs that are downloaded to the computer by clicking a certain link, or downloaded a security update of sorts. When these programs are installed in the computer, they wait until the user proceeds to do his online baking and then records their personal information and takes screen shots of the bank page. This information is then relayed to the hackers behind the operation and they use it to steal the money

References

Cydnie:

https://www.rbcroyalbank.com/onlinebanking/bankingusertips/security/index.html

http://www.cibc.com/ca/legal/online-banking-security.html

https://www1.bmo.com/cgi-bin/netbnx/NBmain

Asima:

Ross Bainbridge, Nov. 28 2008 http://ezinearticles.com/?History-of-Online-Banking&id=270075

my Business, Nov.28 2008 http://www.mybusiness.co.uk/YYfSme9oAI8d7Q.html

M/Cyclopedia, Nov. 28 2008 http://wiki.media-culture.org.au/index.php/E-commerce_-_Overview_-_Online_Banking

Online Security Authoirty, Nov. 30 2008 http://banking.onlinesecurityauthority.com/the-history-of-online-banking-and-its-projected-future/

Andrew:

Tiwari, Rajnish and Buse, Stephan(2007): The Mobile Commerce Prospects: A Strategic Analysis of Opportunities in the Banking Sector, Hamburg University Press (E-Book as PDF to be downloaded)

Tiwari, Rajnish; Buse, Stephan and Herstatt, Cornelius (2007): Mobile Services in Banking Sector: The Role of Innovative Business Solutions in Generating Competitive Advantage, in: Proceedings of the International Research Conference on Quality, Innovation and Knowledge Management, New Delhi, pp. 886–894.

Tiwari, Rajnish; Buse, Stephan and Herstatt, Cornelius (2006): Customer on the Move: Strategic Implications of Mobile Banking for Banks and Financial Enterprises, in: CEC/EEE 2006, Proceedings of The 8th IEEE International Conference on E-Commerce Technology and The 3rd IEEE International Conference on Enterprise Computing, E-Commerce, and E-Services (CEC/EEE'06), San Francisco, pp. 522–529.

Tiwari, Rajnish; Buse, Stephan and Herstatt, Cornelius (2006): Mobile Banking as Business Strategy: Impact of Mobile Technologies on Customer Behaviour and its Implications for Banks, in: Technology Management for the Global Future - Proceedings of PICMET '06.

Owens, John and Anna Bantug-Herrera (2006): [1] Catching the Technology Wave: Mobile Phone Banking and Text-A-Payment in the Philippines

Tarek: http://news.bbc.co.uk/2/hi/uk_news/politics/6177555.stm

http://www.cba.ca/en/viewDocument.asp?fl=3&sl=308&tl=312&docid=570

http://www.cba.ca/en/ViewDocument.asp?fl=3&sl=308&tl=360&docid=716